Some Known Questions About Small Business Accounting Service In Vancouver.

Table of ContentsLittle Known Questions About Tax Accountant In Vancouver, Bc.What Does Small Business Accounting Service In Vancouver Do?The 30-Second Trick For Virtual Cfo In VancouverWhat Does Virtual Cfo In Vancouver Do?Unknown Facts About Virtual Cfo In VancouverTax Consultant Vancouver Fundamentals Explained

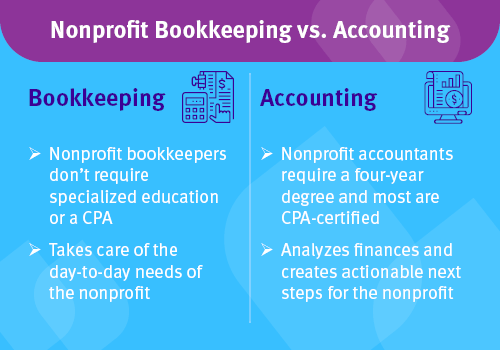

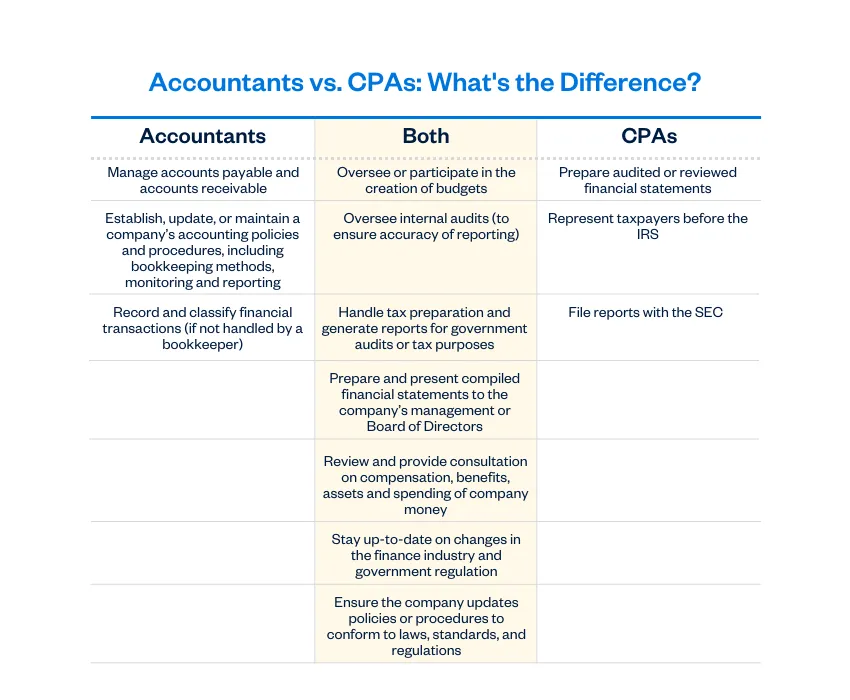

Below are some advantages to employing an accountant over an accountant: An accounting professional can give you a detailed view of your organization's economic state, in addition to techniques as well as suggestions for making monetary decisions. Meanwhile, bookkeepers are just liable for recording economic purchases. Accounting professionals are required to finish more education, qualifications as well as job experience than accountants.

It can be difficult to determine the proper time to employ an accounting professional or accountant or to establish if you need one whatsoever. While many small companies employ an accounting professional as a specialist, you have several choices for dealing with financial tasks. For instance, some little company owners do their very own accounting on software application their accounting professional advises or utilizes, offering it to the accounting professional on a weekly, month-to-month or quarterly basis for action.

It may take some background research study to find an appropriate bookkeeper since, unlike accounting professionals, they are not called for to hold an expert accreditation. A strong endorsement from a trusted associate or years of experience are very important aspects when employing an accountant. Are you still uncertain if you require to work with someone to aid with your publications? Below are three instances that suggest it's time to hire a financial specialist: If your taxes have become as well complex to manage on your own, with numerous revenue streams, international investments, numerous deductions or other factors to consider, it's time to work with an accounting professional.

The Greatest Guide To Pivot Advantage Accounting And Advisory Inc. In Vancouver

:max_bytes(150000):strip_icc()/Term-Definitions_managerialaccounting-a5426d8c4b6941c2bc81cc300a43bfb3.jpg)

For local business, adept cash money management is a critical element of survival and growth, so it's important to deal with a financial specialist from the beginning. If you prefer to go it alone, consider starting with bookkeeping software as well as keeping your books thoroughly approximately day. In this way, must you require to work with a specialist down the line, they will have presence right into the full financial background of your company.

Some resource interviews were carried out for a previous version of this article.

The Basic Principles Of Virtual Cfo In Vancouver

When it pertains to the ins and outs of taxes, audit and money, nevertheless, it never hurts to have an experienced expert to rely on for assistance. A growing variety of accountants are additionally taking treatment of things such as money flow projections, invoicing as well as human resources. Ultimately, most of them are handling CFO-like roles.

For instance, when it concerned using for Covid-19-related governmental financing, our 2020 State of Small Service Research found that 73% of local business proprietors with an accountant said their accountant's recommendations was essential in the application process. Accounting professionals can also aid local business owner prevent expensive mistakes. A Clutch survey of small company owners programs that greater than one-third of local business listing unanticipated expenditures as their top economic obstacle, complied visit this web-site with by the mixing of business and personal finances as well as the lack of ability to receive payments in a timely manner. Small company proprietors can expect their accounting professionals to aid with: Selecting the organization structure that's right for you is essential. It impacts just how much you pay in taxes, the documentation you need to submit as well as your personal obligation. If you're looking to convert to a different service structure, it could lead to tax consequences and also other issues.

Also firms that are the very same dimension as well as market pay certified general accountant very various amounts for accounting. Before we enter into buck figures, let's speak about the expenditures that go into small company accounting. Overhead expenditures are prices that do not directly become a profit. Though these costs do not exchange money, they are required for running your organization.

See This Report about Virtual Cfo In Vancouver

The typical expense of accounting solutions for small business varies for each one-of-a-kind situation. Yet given that accountants do less-involved tasks, their rates are commonly more affordable than accounting professionals. Your monetary service fee depends on the job you require to be done. The ordinary month-to-month bookkeeping fees for a local business will rise as you include extra services and the tasks obtain more difficult.

For example, you can videotape purchases as well as procedure pay-roll making use of on-line software program. You get in quantities into the software application, and the program calculates overalls for you. In some cases, payroll software program for accountants permits your accountant to supply pay-roll processing for you at very little additional expense. Software program solutions can be found in all shapes and also dimensions.

Getting My Pivot Advantage Accounting And Advisory Inc. In Vancouver To Work

If you're a brand-new local business owner, do not forget to variable accounting prices into your budget plan. If you're a veteran owner, it may be time to re-evaluate accounting expenses. Administrative prices as well as accounting professional fees aren't the only accountancy expenditures. Vancouver tax accounting pop over here company. You must additionally think about the results accountancy will certainly have on you and your time.

Your capability to lead staff members, offer clients, as well as choose might suffer. Your time is additionally valuable and should be thought about when considering audit expenses. The time spent on bookkeeping tasks does not produce profit. The less time you spend on accounting and also tax obligations, the even more time you need to grow your service.

This is not planned as legal guidance; to find out more, please click on this link..

Everything about Small Business Accountant Vancouver